Kuwil Trading Method

Data science & Artificial intelligence

Artificial intelligence, along with related fields such as machine learning and data mining, relies on established methods and concepts. In contrast, data science stands out as one of the most comprehensive and multidisciplinary domains, distinguished by its ability to integrate concepts and methodologies from a vast range of disciplines—spanning the natural sciences, applied sciences, and even the humanities. At its core, data science leverages these diverse perspectives to address complex problems, overcome challenges in data analysis, and enhance the interpretation and application of results.

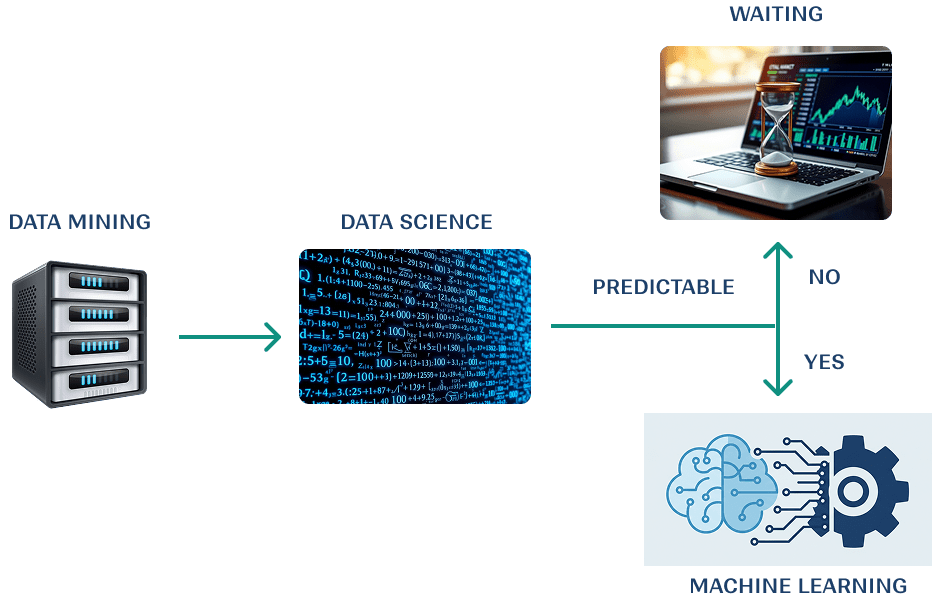

The movement and behavior of living organisms, even the environment in which they live, and the entire world around us are governed by universal and cosmic laws. Therefore, all readings that are taken and recorded contain patterns that reflect these cosmic laws. Artificial intelligence has revolutionized the world by recognizing these patterns, even the hidden and overlapping ones, including images, videos, and Natural Language Processing NLP. The big challenge lies in the financial markets in general and the ambiguity and many external influences (microeconomic and macroeconomic) that surround them. The theory of supply and demand has been the main driver of market movement since time immemorial, but this is not necessarily the reason behind the rise or fall of a certain financial performance. Therefore, artificial intelligence has been unable to overcome this deep and complex challenge, which is that patterns exist in conflicting ways in many cases, which makes the data not carry any type of patterns that can be recognized and extracted.

The Challenge of Identifying

Market Patterns

Financial markets operate under universal economic and behavioral laws, yet predicting price movements remains a complex challenge. AI has proven effective in recognizing hidden patterns in images, videos, and Natural Language Processing (NLP), but when it comes to financial markets, external influences such as microeconomic and macroeconomic factors introduce high volatility and unpredictability.

The traditional theory of supply and demand does not always dictate price movements, making it difficult for conventional AI models to extract recognizable patterns from market data.

Why Traditional AI Struggles in Financial Market Prediction

Traditional algorithm & NN

ANN, RNN & CNN

Need numerical analysis and data science

Three illustrations can effectively simplify this concept. The first depicts a scenario where identifying the correct path is straightforward, relying on basic tools like a paved road or clear signage. The second introduces a more complex situation, where discerning the correct path requires intense focus and careful observation. Finally, the third scenario necessitates tools beyond what is immediately available on the ground such as navigating by stars and celestial bodies.

This progression underscores the value of leveraging advanced methodologies from fields like numerical analysis and data science. By incorporating additional dimensions, such as time and holistic analysis, a deeper understanding and more accurate decision-making can be achieved.

Kuwil’s approach

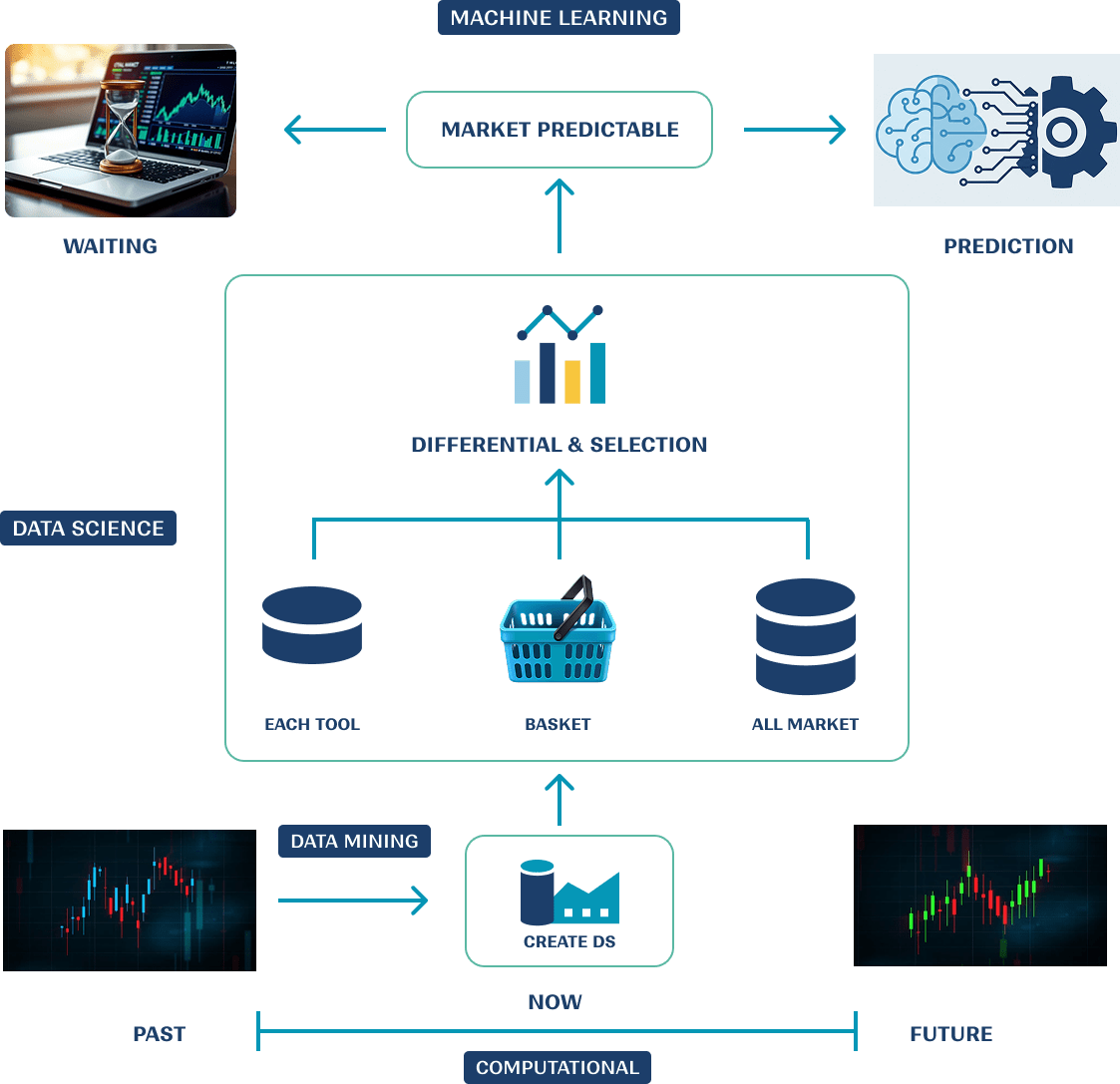

To address this challenge, we developed a novel technique that introduces a new criterion of similarity and a specialized algorithm. This algorithm establishes an appropriate environment that allows ML to effectively recognize and extract patterns. Our approach integrates data mining and data science to construct a visual framework (or window) for ML as shown in the figure.

-

The time used to form the japanese candlestick and the time applied to the objects within the dataset.

-

The Concordance rate and Correlation relationship.

-

Accuracy and the Threshold Accuracy Score.

Three Levels of Analysis

What distinguishes this method is its use of data science to analyze market conditions, greatly enhancing the bot’s efficiency. The analysis is performed on three levels, assessing all market tools along with a set of influential tools that affect a specific target tool (such as a pair or share). This approach identifies the behavioral trends of the target tool by leveraging advanced concepts in numerical analysis. As a result, scores are generated for each financial tool, indicating its suitability for trading based on machine learning models.

The Differential and Selection stage then refines the data, retaining only the most significant patterns and features. This leads to greater flexibility in capital and risk management. In this way, any financial tool will be traded with an appropriate and acceptable level of points, which is determined by the risk management expert. Among the specifications of the Kuwil trading method are:

- It is based on scalping trading.

- High computational power and high frequency trading raise the efficiency.

- It requires certain conditions to work with markets other than Forex.

- It can be specialized for a specific number of tools, such as euruse, nzdcad, etc.

- Four indicators with two different coefficients were selected as standard feature for all financial tools in the Forex market.

- Since it is a scalping strategy, trading during periods of high liquidity is essential.

- With minimal data and a basic machine learning algorithm, it can produce good and acceptable results.

- Its reliance on machine learning does not exceed 30%.

- Outliers within the dataset can improve the efficiency of the method.

Unlocking Opportunities with BreakAxis FX.

Our BOT not only delivers precise trading insights but also fosters smarter, data-driven decisions. By leveraging cutting-edge tools and a unique methodology, BreakAxis FX empowers you to thrive in competitive markets.

Partner with us to redefine success in the financial landscape. At BreakAxis FX, innovation meets opportunity, creating pathways to prosperity for institutions that demand the best.